Data Driven Trading

The value adding usage of data is nowadays key in the financial industry. Read the first article of our new "insights" series and find out how Vontobel is tackling and mastering this crucial challenge.

Big data in financial trading

In the era of digital transformation, big data revolution has found a resonance with financial firms considering the value of data. Especially as its volume and variety have significantly increased. According to the report from IBM, 90% of all data in the world has been created in the last two years alone . The pace of data generation is exponential. Today, it would take a person approximately 181 million years to download all the data from the internet . Digitalization, automation, increased use of sophisticated technologies and regulatory changes in the financial markets modify the trading landscape. Evergrowing fragmentation of liquidity across multiple trading platforms and greater complexity of execution strategies constantly challenge market participants. It is therefore essential to understand and measure the cost of trading. Every client, trader, execution algorithm or broker generates ongoing streams of data that may reveal useful insights. Capturing this data and making sense of it is absolutely necessary for success. Although the potential of data is practically limitless, too few companies make use of their data and thus lose competitive advantages. Most firms still struggle to extract the genuine value of their data.

True order transparency

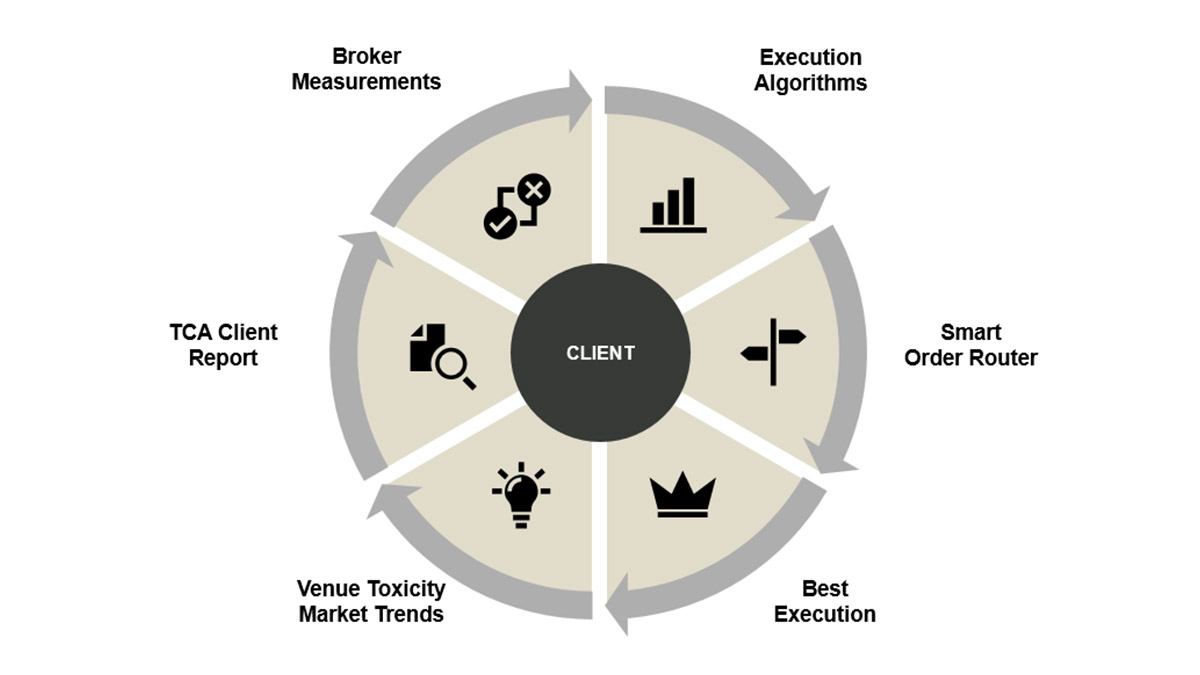

The combination of our experience and the hidden value of available data assets encouraged us to build a modern and forward-looking Transaction Cost Analysis (TCA) tool. Our solution supports best execution, provides actionable insights to enhance productivity and quickly transforms data into decisions. Moreover, it supports the discovery of business opportunities and finally delivers a superior client experience. In today’s data-driven world, we have decided to develop a strategy focused on powerful analytics to deliver specific recommendations that lead to better execution performance.

We believe that taking a holistic approach to highly complex execution data plays a crucial role in driving innovation and client-centricity. By bringing together high-quality data and digital technologies, we get closer to our clients. We understand their needs, which enables us to provide tailored solutions that meet their expectations. The ultimate objective of our solution is to provide our customers with insights that support them with informed decision making activities.

Our powerful and intuitive analytics platform turns trade analysis into a source of valuable and relevant information. The TCA Platform delivers precious insights related to execution quality and keeps us ahead of the curve by providing in-depth information for business development. At the same time, we maintain complete neutrality by applying benchmarks from an independent benchmark provider. By buying data from a non-indigenous source, we ensure full objectivity in assessing the quality of our execution.

The pleasure of Comparison

In the post-MiFID II world, TCA became a real superstar. The value of quantifiable objectives for measuring and monitoring the performance of trading activities in comparison to various benchmarks and the comprehensive historical trading performance metrics of the industry is rapidly gaining high importance.

The goal of our analytics platform is to increase the transparency of trading activities. We precisely monitor and analyze the behavior of the Smart Order Router (SOR) and the execution algorithm strategies to make meaningful decisions on modifications in algo design and routing policies. Additionally, our analytics include detailed metrics designed to track efficiency, accuracy and performance of brokers and venues. TCA considerably increases visibility over execution quality so that decisions can be optimized to respond to market conditions.

As the timestamp granularity has been reduced, the quantitative evaluation of the performance is now very valuable and insightful. With the ability to capture all details of orders and executions down to the microsecond level and compare the independent market data to an investor’s trades that are provided with the same precision, we can offer a full spectrum of broad and in-depth analysis, from Best Execution to global TCA. Customized analytics do not only provide our clients with full transparency on their trading activities but also support them in discovering growth opportunities. Taking advantage of data in order to improve customer experience and increase the efficiency of the entire value chain is our main goal. Thanks to the insights generated by our interactive analytics platform, our clients can discover new opportunities every day.

1 Source: IBM Marketing Cloud, “10 Key Marketing Trends For 2017”

2 Source: Physics.org “Thank physics for… the Internet” (calculation with 33 zettabytes of data and an average download speed of 46Mbps)