Trading at the close

Published on 19.11.2025 CET

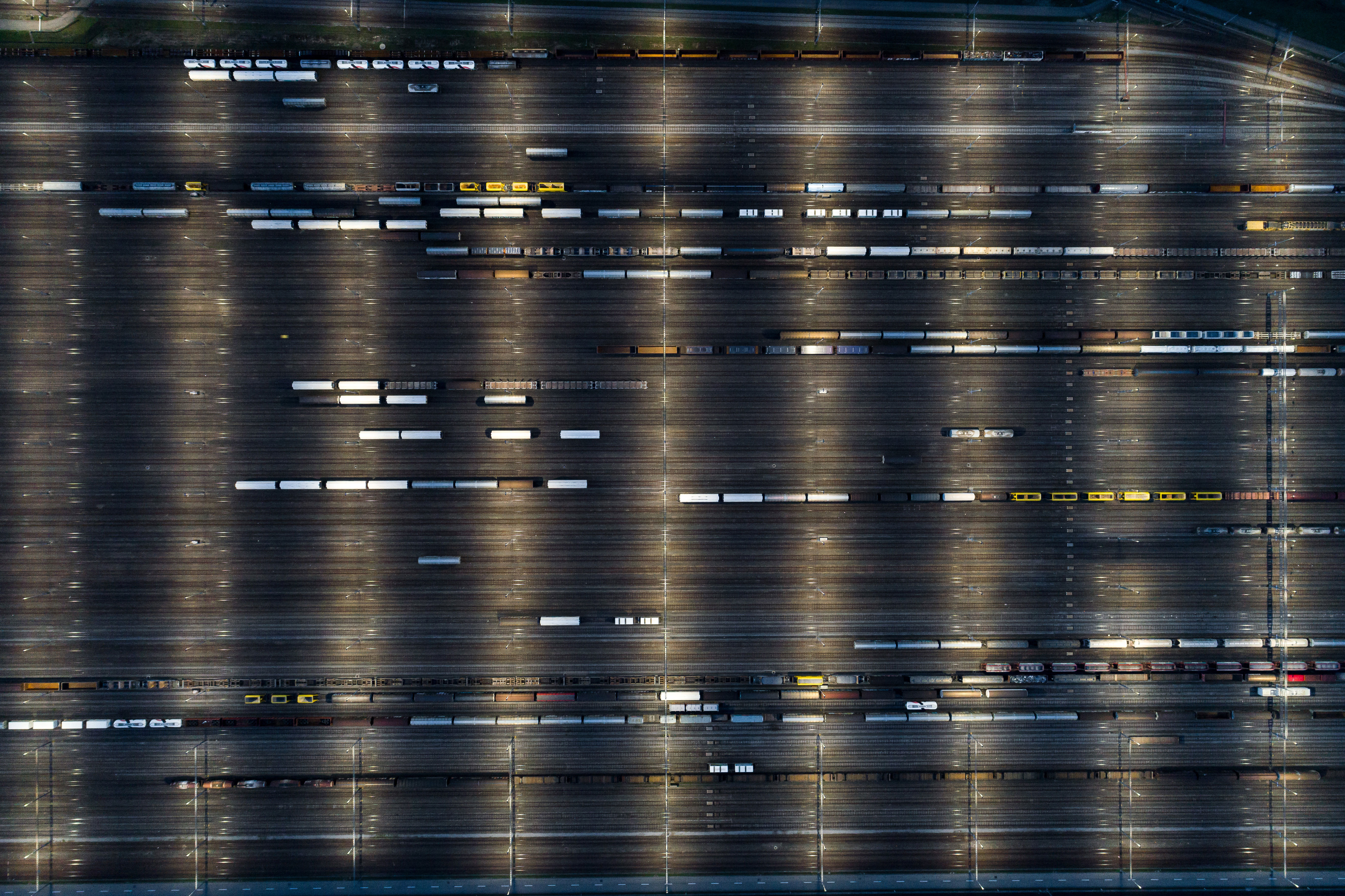

Large portfolio trades that are benchmarked at the closing price require special care. Our Target Market-on-Close algorithm automatically assesses expected liquidity and minimizes the potential market impact at the closing auction for large orders.

The client flow that our algorithms handle on a daily basis varies in nature and profile. The two most frequently used algorithms in our portfolio are the VWAP, which targets the volume-weighted benchmark price, and PACE, our flagship algorithm that combines implementation shortfall and liquidity-seeking styles and is benchmarked at arrival price. The use cases for these algorithms range from very brief aggressive trades to multi-day slow executions on some illiquid instruments.

However, in many cases, clients’ needs necessitate sending an order specifically to the closing auction. This occurs with individual stocks when traders anticipate a substantial overnight gap, for example, due to an upcoming earnings call the next morning. It is even more common for program trades when a portfolio manager rebalances a portfolio that is benchmarked at the closing price. In these situations, the use of traditional algorithms, such as VWAP, carries market risk—the difference between the benchmark and the closing price.

For such program trades, traders often send “at-the-close” market (rarely limit) orders that simply enter the closing auction. This type of trade, however, places an extra burden on the traders themselves: they must ensure that their order is not so large that it pushes the price of the auction or, in the worst case, leads to a “non-opening,” when the auction book cannot uncross due to imbalance. For a few instruments it is a relatively straightforward task to compare order size with expected auction volume. However, for a portfolio of 30 to 50 stocks, it becomes burdensome. Further difficulty arises when the trade is large for some of the instruments, requiring the trader to plan the execution to start during the day and select an appropriate algorithm.

Trading team, from left to right:

Adriano Mundo is an Algorithmic Trading Engineer who focuses on operational research, benchmark-oriented algorithms, and FX components.

Cyril Hottinger is a Senior Algorithmic Trading Engineer responsible for the core execution systems, smart order router (SOR), and liquidity-seeking strategies.

Dr. Vladimir Filimonov is Head of Algorithmic Trading, responsible for the full pipeline of the algo strategy design: from idea and research to implementation and live trading.

Adrian Willi is a Quantitative Researcher who focuses on developing new predictive models for trading strategies.

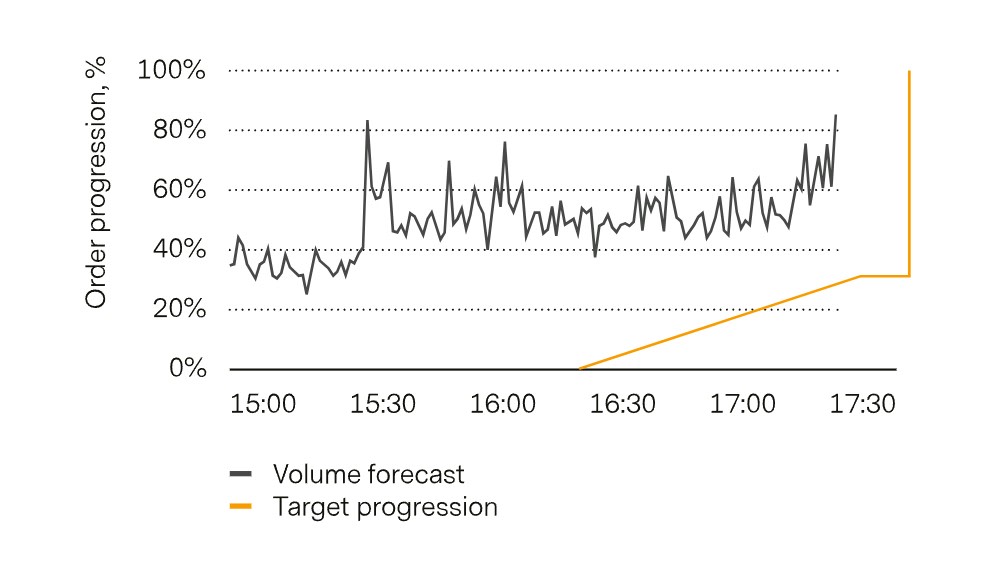

To assist traders in automating this routine process, we have designed the Target Market-on-Close (TMOC) algorithm. Upon receiving an order, TMOC uses an internal quantitative model to forecast the closing auction volume. The volume model relies on historical data for intraday and auction liquidity and considers many features, including special days such as witching and triple witching days or index rebalancing. If the order is deemed suitable for the auction, it will simply place it at the auction at the market or limit price. However, if the order is too large for the auction alone, the algorithm will use the intraday volume forecast based on historical liquidity to determine when it should start during the trading day so that it can be expected to trade below a certain participation rate (by default, 35 percent). By starting during the trading day before the closing auction, the algorithm will source liquidity from both primary and MTFs as well as from all alternative liquidity venues, such as periodic auctions, dark pools, and conditional venues, as well as from the unique liquidity at systematic internalizers and request-for-quote platforms such as Tradeweb or SIX Quote on Demand.

As is the case with all our algorithms, TMOC orders are closely monitored by the Global Execution team. In most instances, TMOC does not require manual intervention. However, in challenging situations, such as unreliable historical data or an extremely large order that requires an extended execution period or may not fit within the trading day, execution traders are alerted and required to make adjustments. These adjustments may include overriding the automatic choices of the algorithm, changing the algorithm to one more suitable for the given situation, or even searching for an OTC block trade. In the most difficult situations, where sourcing the required amount of liquidity appears unfeasible, our trading team will contact the client to discuss how to proceed with the specific order.

This combination of automated electronic-execution algorithms, which are powered by proprietary quantitative models and historical data, and human oversight is a hallmark of the execution process at Vontobel’s Transaction Banking unit. The TMOC algorithm has been successfully adopted by both our internal traders and external Asset Management and Private Banking institutions. Since its inception at the end of 2023, the algorithm has executed more than 8,000 orders and has become a vital part of our portfolio of execution algorithms. TMOC is currently available through Vontobel’s Electronic Sales Trading and Global Execution desks, as well as through the following electronic channels: TradingScreen (TradeSmart and QUO), BlackRock Aladdin, Bloomberg EMSX, FlexTrade, Glox, and FIX.

Contact us

Published on 19.11.2025 CET

ABOUT THE AUTHORS

Show more articles

Show more articlesDr. Vladimir Filimonov

Head of Algorithmic Trading

Vladimir Filimonov heads the Algorithmic Trading team in the Transaction Banking unit at Vontobel. He is responsible for design and implementation of the execution trading strategies.